HI Market View Commentary 11-07-2022

HI Market View Commentary 11-07-2022

Round two of my thoughts on investing in bearish markets and market psychology

When the market goes on sale it seems like everyone runs out of the store even though great companies go on sale?

Fear, losing money, an emotional attachment, this time is different with new end of the world reasons to get out

With my sons Traumatic brain injury (TBI) = Patience, small wins, small gains, little improvements,

Hope= Red Wave = that means the house is now republican and NOTHING will get thru, improved economy=last rate hike for awhile

We want a fed pause in rate hikes

Will BIDU go up?

Stock Price Forecast

The 35 analysts offering 12-month price forecasts for Baidu Inc have a median target of 181.33, with a high estimate of 269.97 and a low estimate of 109.21. The median estimate represents a +98.79% increase from the last price of 91.22.

Earnings dates:

BIDU 11/16 est

COST 12/08 AMC

DG 12/01 est

DIS 11/08 AMC

MU 12/20 AMC

TGT 11/16 BMO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 04-Nov-22 15:22 ET | Archive

“Tardius, Altius, Diutius – Communiter” is the Fed’s new motto

For more than 100 years, the Olympic motto was “Citius, Altius, Fortius.” Those Latin words translate to “Faster, Higher, Stronger.” In July 2021 the International Olympic Committee (IOC) revised that motto to include the word “Communiter,” which means together.

The new motto, then, is: “Citius, Altius, Fortius – Communiter.”

We got to thinking about this motto because we have been struck by the Fed’s Olympian mentality when it comes to raising interest rates. Since March 2022, the Fed’s approach has been faster, higher, stronger – together (there haven’t been any dissents at the last three meetings, all of which culminated in a 75 basis points increase in the target range for the fed funds rate).

A revision, though, now seems to be in order for the Fed based on the remarks heard from Fed Chair Powell following the November FOMC meeting.

It is no longer “Citius, Altius, Fortius – Communiter.” We would submit that the Fed’s new motto is “Tardius, Altius, Diutius – Communiter,” which in a post-Vatican II world translates to “Slower, Higher, Longer – Together.”

Out of the Block

The Fed has moved like an Olympic sprinter changing the target range for the fed funds rate, which stood at 0.00-0.25% on January 26 and is now at 3.75-4.00%. The Fed has moved as quickly as it has because it recognized in the inflation data that it remained stuck in the starting block far too long.

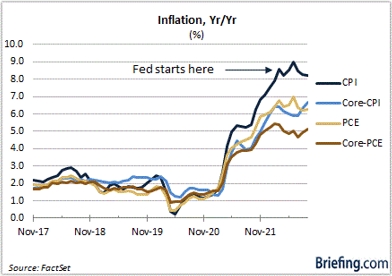

When the Fed finally started running in March, the Consumer Price Index (CPI) was up 8.6% year-over-year and core CPI, which excludes food and energy, was up 6.4%. The PCE Price Index was up 6.4% year-over-year and the core-PCE Price Index, which excludes food and energy and is the Fed’s preferred inflation gauge, was up 5.4%.

The inflation rates have been leveling off, but as can be seen in the chart, they are not coming down in any meaningful way. In fact, Fed Chair Powell conceded at his press conference that, “There’s no sense that inflation is coming down. If you look at — I have a table of the last 12 months of 12-month readings, there’s really no pattern there. We’re exactly where we were a year ago.”

This “sticky” inflation is what is bothering the Fed the most, yet the recent policy directive made an allowance for the idea that the lag effect of the previous rate hikes could help unstick things.

That view was captured in the following line:

“In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

This perspective is why the market thinks the Fed may raise rates “only” 50 basis points at its December 13-14 FOMC meeting. The latest read of the CME’s Fed Watch Tool shows a 56.8% probability of a 50-basis points rate hike in December.

A Way to Go

The Fed, therefore, may slow the pace of its rate hikes, but it is still going to raise rates further. That was the implicit message from Fed Chair Powell, who said, “When (people) hear lags, they think about a pause. It’s very premature in my view to be thinking about or talking about pausing our rate hike. We have a way to go. We need ongoing rate hikes to get to that level of restrictive. We don’t know where that exactly is.”

Separately, he acknowledged that the assessment of further tightening comes down to three questions: how fast to go; how high to raise our policy rate; and how long to remain at a restrictive level?

The market wishes there were definitive answers to each question, but there isn’t at this juncture. That uncertainty is creating excess volatility around each economic release that pertains to inflation and employment since the trends in those areas are the fulcrum upon which monetary policy will pivot.

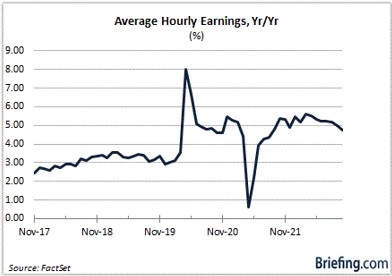

We noted above that the Fed chair isn’t comfortable with where inflation sits today. He is also struck by how resilient the labor market has been, noting that the unemployment rate is still sitting near a 50-year low and that wage inflation, while flattening out, is still well above the level that would be consistent over time with 2.0% inflation.

So, there won’t be a pause in the Fed’s rate hikes. There are more to come, and the Fed Chair acknowledged that incoming data since the last meeting suggests the ultimate level of interest rates (i.e. the terminal rate) will be higher than previously expected. He also said that he thinks it is very difficult to make the case that the current target range for the fed funds rate is too tight given that inflation still runs well above that target range.

No one knows yet what the terminal rate will be, yet the fed funds futures market now thinks it will be 5.00-5.25% by June 2023.

The CME’s FedWatch Tool indicates that the fed funds futures market assigned a 0% probability to that being the case a month ago. It is a moving target alright. To get from here to there will involve another 125 basis points worth of rate hikes, assuming that does in fact end up being the terminal rate.

What It All Means

It is not normal for the Fed to raise its policy rate by 75 basis points. The normal course of things over the past 30 years has been to move rates up, or down, in 25-basis point increments. There have been some 50-basis point moves along the way, but 75 basis points is a true outlier.

Accordingly, it says something about the Fed’s race to catch up that it just implemented its fourth, consecutive 75-basis point hike and left the door open for another 75-basis point move at the December meeting.

It is moving at Usain Bolt-like speed. The difference is that Bolt won several Olympic gold medals. The Fed for its part gets a participation ribbon but is still a long way from the podium.

It will be appropriate for the Fed to slow the pace of increases and that time is coming. Those aren’t our words. They are Fed Chair Powell’s words. He isn’t uttering any word, however, that suggests the Fed is done raising rates and considering cutting rates.

For the Fed and the market, it is “Tardius, Altius, Diutius – Communiter.”

—Patrick J. O’Hare, Briefing.com

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF OCT. 31 THROUGH NOV. 4, 2022 |

| The S&P 500 index fell 3.3% last week amid escalating worries over rising interest rates and their impact on the economy. The market benchmark ended Friday’s session at 3,770.55, down from last Friday’s closing level of 3,901.06. While the S&P 500 ended October on Monday with an 8% monthly jump, it is already down 2.6% so far for the new month after just the first four November sessions. It is also down 21% for the year to date. Last week’s tumble came as the Federal Reserve’s Federal Open Market Committee raised its key benchmark rate by another 75 basis points and signaled that rates will be boosted to an ultimate level higher than previously expected as it continues trying to fight inflation. This was a disappointment as investors had been hoping the rate increases so far were working well enough for the FOMC to start talking about a slowdown in rate increases. Adding to investors’ concerns, many companies have been citing macroeconomic challenges when reporting Q3 results and issuing guidance. Friday, jobs data showed a seasonally adjusted 261,000 jobs were added in October, showing some resilience but also indicating some cooling as this represented the smallest monthly gain since December 2020. The unemployment rate edged up to 3.7% from 3.5% in September. Most of the S&P 500’s sectors fell last week. Communication services had the largest percentage drop, down 7.4%, followed by a 6.9% decline in technology and a 5.8% slip in consumer discretionary. Energy led the few sectors that managed to rise week over week. The energy sector climbed 2.4%, followed by a 0.9% increase in materials and a 0.4% rise in industrials. Among the decliners in communication services, shares of Paramount Global (PARA) fell 18% on the week as the film and entertainment company reported weaker-than-expected third-quarter results, citing macroeconomic pressures that weighed on advertising revenue. In the technology sector, Fidelity National Information Services (FIS) reported Q3 adjusted earnings per share a penny below the Street consensus estimate, forecast Q4 results below Street views, and cut its full-year guidance. Shares of the financial services technology company tumbled 29%. In consumer discretionary, Amazon.com (AMZN) shares lost 12% as the retailer said the company is pausing “new incremental hires” for its corporate workforce amid uncertain economic conditions. The energy sector’s gainers, meanwhile, included shares of ConocoPhillips (COP), which rose 4% last week as the company reported Q3 adjusted earnings per share and revenue above year-earlier results as well as analysts’ mean estimates. The energy explorer and producer also boosted its quarterly ordinary dividend by 11% and approved a $20 billion increase to its share-buyback program to $45 billion. Next week’s earnings calendar features companies such as Activision Blizzard (ATVI), Walt Disney (DIS), Occidental Petroleum (OXY), DuPont (DD), D.R. Horton (DHI) and AstraZeneca (AZN). The economic calendar will be light earlier in the week but will get more attention on Thursday, when the consumer price index for October will be released, while Friday will feature an early reading from the University of Michigan on November consumer sentiment. Provided by MT Newswires |

Where will our markets end this week?

Higher

DJIA – Bullish

SPX –technically bullish

COMP – Bearish

Where Will the SPX end November 2022?

11-07-2022

10-31-2022 4.0%

Earnings:

Mon: ATVI, LYFT, MOS

Tues: DD, DDD, AKAM, DIS

Wed: DHI, WEN, BYND

Thur: DDS

Fri:

Econ Reports:

Mon: Consumer Credit

Tue NFIB Small Business, ELECTIONS

Wed: MBA, Wholesale Inventories

Thur: Initial Claims, Continuing Claims, CPI, Core CPI, Treasury Budget

Fri: Michigan Sentiment

How am I looking to trade?

Currently have protection on for earnings, Bank stocks are running unprotected based on their earnings, SPY puts in accounts for possible earnings disappointment

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Should we be investing in China? 2nd Largest economy and by far it has the most ADR’s/Stocks on the US Exchanges

Wall Street believes these 4 Dow stocks will lead the index after one of its best months ever

PUBLISHED MON, OCT 31 20221:14 PM EDTUPDATED 2 HOURS AGO

As the Dow Jones Industrial Average climbs to its best month in decades, investors may be looking for the stocks poised to continue the upward momentum.

The 30-stock index has been on a tear in October. It notched a four-week winning streak for the first time since November 2021 and is up 14% on the month. If the gains hold Monday, it will be the best month for the index since 1976.

The S&P 500 and tech-heavy Nasdaq are also up for the month but lagging the Dow. The S&P 500 is up more than 8% in October, while the Nasdaq is up more than 4%.

To screen for stocks that will lead the Dow going forward, CNBC Pro looked at all members of the index and sorted out those where at least 70% of analysts covering have a buy rating. Then CNBC Pro found the stocks that have at least 10% upside to the consensus target price.

STOCKS POISED TO LEAD THE DOW

| SYMBOL | NAME | (%) BUY RATING | TARGET PRICE % | 1M MOVE |

| MSFT | Microsoft Corporation | 78.4 | 26.7 | -2.2 |

| CRM | Salesforce, Inc. | 78.0 | 32.2 | 8.6 |

| V | Visa Inc. Class A | 71.4 | 18.4 | 16.8 |

| DIS | Walt Disney Company | 71.4 | 29.1 | 6.6 |

Source: Factset

The stocks set to lead the Dow

That yielded four stocks well-known to investors. Microsoft, the stock with the highest share of analysts that say to buy the company, has a more than 26% upside to its consensus target price.

The stock is also trading at a bit of a discount — shares are down more than 2% on the month and more than 30% on the year as the technology sector has been hit by the threat of recession and higher interest rates.

Shares slipped last week when the company released earnings that included a weaker-than-expected forward guidance even though Microsoft beat on top and bottom lines in its last quarter. Still, analysts covering the company are bullish on its future.

Analysts at Goldman Sachs cut their near-term earnings estimates and price target slightly but see changes that the company is making as beneficial in the long term.

“Looking beyond near-term dynamics, we remain constructive as we see the company well positioned to continue to win deals and expand its wallet share within its existing customer-base, even in a slower growth environment,” wrote analyst Kash Rangan in an Oct. 25 note.

The next company on the list, Salesforce, has the highest upside to its consensus price target — analysts see it gaining more than 32%. It also has a 78% buy rating and gained more than 8% last month.

It also has an activist investor stamp of approval. In mid-October, Starboard Value revealed it had taken a significant stake in the company, saying that there is still significant opportunity for the enterprise software maker. Shares traded higher on the news.

Visa, the credit card company, had the largest one-month gain of the group, with shares up more than 16% in recent weeks. Shares of the company jumped when it announced its quarterly earnings, where it beat Wall Street’s expectations on both the top and bottom lines.

Analysts see the company gaining even more — more than 71% covering Visa have a buy rating on shares, with an average upside of 18.4%.

The Walt Disney Company rounds out the list. More than 71% of analysts covering the company have rated it a buy and see a 29% upside to price targets.

The company in August reported solid quarterly earnings that beat on the top and bottom lines. In addition, Disney+ subscriptions rose to 152.1 million, much more than the 147 million analysts expected, according to StreetAccount. Disney also announced that it would add an advertising tier into its pricing structure for its streaming service.

Correction: A previous version of this story misspelled analyst Kash Rangan’s name.

Apple beats but comes up light on iPhone sales and services

PUBLISHED THU, OCT 27 20228:00 AM EDTUPDATED THU, OCT 27 20226:00 PM EDT

KEY POINTS

- Apple reported fiscal fourth-quarter earnings on Thursday that beat Wall Street expectations on revenue and earnings per share.

- Apple came up short versus revenue expectations in core product categories including the company’s iPhone business and services.

Apple reported fiscal fourth-quarter earnings on Thursday that beat Wall Street expectations on revenue and earnings per share.

However, Apple came up short versus revenue expectations in core product categories including the company’s iPhone business and services.

Apple shares rose over 1% in extended trading.

Here is how Apple did versus Refinitiv consensus estimates:

- EPS $1.29 vs. $1.27 est.

- Revenue. $90.15 billion vs. $88.90 billion estimated, up 8.1% year-over-year

- iPhone revenue: $42.63 billion vs. $43.21 billion estimated, up 9.67% year-over-year

- Mac revenue: $11.51 billion vs. $9.36 billion estimated, up 25.39% year-over-year

- iPad revenue: $7.17 billion vs. $7.94 billion estimated, down 13.06% year-over-year

- Other Products revenue: $9.65 billion vs. $9.17 billion estimated, up 9.85% year-over-year

- Services revenue: $19.19 billion vs. $20.10 billion estimated, up 4.98% year-over-year

- Gross margin: 42.3% vs. 42.1% estimated

Apple did not provide official guidance for its first fiscal quarter, which ends in December and contains Apple’s biggest sales season of the year. It hasn’t provided guidance since 2020, citing uncertainty.

However, Apple CFO Luca Maestri gave investors a few data points that caused the stock to dip momentarily during the company’s earnings call.

He said that total year-over-year revenue would grow in December less than the 8.1% during the September quarter. He added that Mac sales would actually decline in the December quarter on an annual basis. He also said that services would grow year-over-year during the quarter, but would be hurt by the macroeconomic environment.

“We’re not providing revenue guidance, but we are sharing some directional insight,” Maestri said.

Apple increased revenue by 8% during the quarter, and Apple CEO Tim Cook told CNBC that it would’ve grown “double-digits” if not for the strong dollar. Total sales in Apple’s fiscal 2022 were up 8% to $394.3 billion.

“The foreign exchange headwinds were over 600 basis points for the quarter,” Cook told CNBC’s Steve Kovach. “So it was significant. We would have grown in double digits without the foreign exchange headwinds.”

Cook told CNBC that Apple had slowed the pace of its hiring. Other tech companies are looking to make cuts ahead of a possible recession and as interest rates rise.

“We are hiring deliberately. And so we’ve slowed the pace of hiring,” Cook said.

Although Apple’s iPhone business increased sales by over 9% on an annual basis, it came up short versus analyst expectations. Apple’s September quarter had 8 days of iPhone 14 sales, and analysts are closely looking for details about if Apple customers are trading up for more expensive models or if the new devices are poised to sustain higher sales through Apple’s fiscal 2023.

Cook indicated that Apple’s performance in phone sales was strong despite signs that other smartphone companies are struggling with a recent decrease in demand and said the company grew “switchers,” or people who bought an Apple phone after having an Android device. He added that the company’s high-end phones, the iPhone 14 Pro, were supply constrained.

“We clearly countered the industry trends on the phone if you look at third party estimates of what the smartphone industry did,” Cook said.

Cook said that supply issues didn’t significantly affect Apple during the period, after several quarters in which supply shortages hurt Apple’s sales. Cook told CNBC said it was paying less for some memory chips.

Apple’s services business also missed estimates.

Apple’s services business reported just under 5% growth during the quarter, a significant slowdown for the investor-favorite and profitable business line versus last quarter, which was 12%.

For the fiscal year, Apple services grew just over 14% to $78.13 billion, a slower rate of growth than 2021′s 16% annual increase, and much slower than 2020′s 27% services growth.

The business includes several different lines, including Apple’s online services like Apple Music and Apple TV+, revenue from the App Store, hardware warranties, and search deals with companies like Google. Apple said it had 900 million total subscriptions, which includes subscriptions to apps through Apple’s App Store.

Apple recently increased prices for Apple Music and Apple TV+, but the increases started during the December quarter.

Cook said the price increases were “disconnected” from Apple’s services performance.

“Well, if you look at the price increases as an example, Music, the licensing cost has increased,” Cook said.

He added that Apple TV+ has more shows now, so Apple feels that the product is more valuable.

Investors generally like Apple’s move into services because the products are more profitable than Apple’s hardware and often bring in recurring revenue.

There were a few bright spots in Apple’s report. Mac sales were up over 25% to $11.51 billion, even as data points from parts suppliers, chipmakers, and competing PC firms were pointing during the quarter to a significant slowdown in laptop and desktop sales after two boom years during the pandemic.

Apple’s Other Products category, which includes Apple Watch and AirPods, also saw an annual increase and beat Wall Street expectations. Some analysts believed that Apple’s wearables were most likely to be hurt if recessionary fears slowed discretionary spending. That business increased nearly 10% year-over-year to $9.65 billion.

Apple’s iPad, which had been hampered by supply issues, decreased nearly 10% year-over-year and is Apple’s smallest individual line of business. The company recently released new models in October, which could boost sales just after the September quarter finished. Cook said that it was a difficult comparison because last year, Apple released new iPads in September.

1 mistake causes 96% of retirees to lose more than $100,000 in Social Security benefits

By B.O.S.S. Retirement Solutions and Advisors | Posted – Oct. 27, 2022 at 7:00 p.m.

This story is sponsored by B.O.S.S. Retirement Solutions.

A shocking statistic from a research study featured in Forbes is getting a lot of attention — 96% of Americans claim their Social Security benefits at the wrong time. And this mistake costs them an average of $111,000.

Even the most sophisticated investors make mistakes with filing for Social Security, and it costs them a lot more than $111,000. Below are three common mistakes that could needlessly cost you thousands of dollars.

Mistake #1: You can’t rely on a one-size-fits-all strategy

While 62 is the earliest age you can start collecting Social Security, conventional wisdom says you should delay filing for as long as possible so you get a bigger check. Many advise at least waiting until your full retirement age because that’s when you can start receiving your full retirement amount. The Social Security Administration puts that number between 66 and 67 years old, depending on the year you were born. (If you were born in 1960 or later, it’s 67.)

However, it’s not always that simple. For some people, it makes sense to retire later and wait to collect the maximum Social Security benefit. But others could lose money by delaying retirement. The strategy that could help you get the most from Social Security will be totally unique to you. Don’t rely on a one-size-fits-all strategy or traditional rule of thumb.

Mistake #2: Ignoring the impact Social Security could have on your taxes, Medicare premiums and other benefits

Most people are solely focused on how to get the biggest benefits check. But there’s more to it than that. Your decision could trigger an avalanche of taxes, double your Medicare premiums, and cause you to forfeit other benefits. It’s critical you don’t base your decision on just the amount of your benefits.

For example, B.O.S.S. Retirement Solutions once worked with a nice couple from Salt Lake City that could have lost hundreds of thousands of dollars from filing at the wrong time. A customized analysis revealed that their strategy would trigger a massive tax bill of $137,251 on their lifetime benefits.

We outlined a different strategy that could eliminate these taxes, so they could keep this $137,251 in their pocket. That kind of money could go a long way in retirement.

Mistake #3: Counting on the Social Security Administration to help you with your decision

Most people don’t realize it, but the people at the Social Security Administration are forbidden to give any personalized advice on filing for your benefits. And in their defense, they’re not equipped to offer advice on how this decision could impact your taxes, Medicare premiums and other benefits.

So, you can’t rely on the Social Security Administration to help you with claiming your benefits. It’s 100% up to you.

Of course, that doesn’t mean you have to figure everything out on your own. A professional advisor can help you formulate a plan that makes sense for your unique financial situation.

“Even if you’re close to—or already in—retirement, an advisor may be able to suggest ways to better manage your income and investments as well as avoid unnecessary taxes,” writes Adam Hayes for Investopedia.

Bottom line

Filing for your social security benefits will be one of the most important financial decisions of your life. Hundreds of thousands of dollars are at stake.

The only way to get the most out of your benefits is to get a customized social security analysis that considers everything, including your benefits, taxes, Medicare premiums, spousal benefits, required minimum distributions and more.

Many companies charge several hundred dollars for a customized analysis. But B.O.S.S. Retirement Solutions underwrites this cost as a courtesy.

If you have questions about your social security benefits, or if you would like to schedule a customized analysis, we’re always here to help. The strategies we use are best suited for people who have saved more than $200k for retirement. Give us a call at 801-216-3683 or email retire@bossretirement.com.

Ryan Thacker and Tyson Thacker are the president and CEO of B.O.S.S. Retirement Solutions with six offices throughout Salt Lake City. They are the winner of Utah’s Best of State Award for retirement planning for the past two years.

This is for illustrative purposes only, results may vary. Advisory services offered through B.O.S.S. Retirement Advisors, an SEC Registered Investment Advisory firm. Insurance products and services offered through B.O.S.S. Retirement Solutions. The information contained in this material is given for informational purposes only, and no statement contained herein shall constitute tax, legal or investment advice. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. You should seek advice on legal and tax questions from an independent attorney or tax advisor. Our firm is not affiliated with the U.S. government or any governmental agency. Marketing materials provided by Infinity Marketing Services.

Goldman Sachs says Boeing can soar more than 80% after earnings

PUBLISHED THU, OCT 27 20228:26 AM EDT

Goldman Sachs said Boeing can soar more than 80% after its latest quarterly report.

“We continue to believe Boeing has substantial deep value upside as financial inputs and valuation both remain at trough while long-term fundamentals are strong. Several inputs are now improving, including aircraft demand, 787 deliveries, services, and total cash flow,” wrote analyst Noah Poponak, who has a buy rating on the stock.

Boeing dropped 9% Wednesday after reporting a $3.3 billion loss in its most recent quarter as challenges in its defense business held back its commercial aircraft unit. Still, the aircraft manufacturer generated nearly $3 billion in free cash flow, and said it expects it will reach positive free cash flow this year.

The analyst said he expects that Boeing’s defense business will improve, and pointed to rising Max jet deliveries as positives for the company.

“As Boeing drives a turnaround, quarterly updates can be mixed. But our mid-cycle free cash estimates have not moved much through this trough period; and continue to imply a lot of upside in the stock over time,” the analyst added.

Goldman Sachs lowered its 12-month price target to $242 from $265. The new price target is still roughly 81% higher than Wednesday’s close at $133.79. Shares of Boeing climbed 1.6% in Thursday premarket trading.

—CNBC’s Michael Bloom contributed to this report.

Stifel says the S&P 500 will rally 15% over the next 6 months as inflation cools

PUBLISHED MON, OCT 24 20229:47 AM EDT

Expect the S&P 500 to rally as much as 15% over the next six months as inflation cools and the Federal Reserve pares back its aggressive tightening campaign, Stifel says.

The firm’s strategist Barry Bannister said in a note to clients Sunday that the benchmark index should hit 4,300 by April 2023, assuming that inflation eases and the central bank’s hawkishness has peaked.

“On the bullish side, we note that fighting history is like fighting the Fed, and cumulatively for 60 years the S&P 500 return is almost nil the 6 months May-October while the next 6 months (November-April) provide almost all cumulative return,” Bannister said.

The setup Bannister describes depends on no recession occurring during the first half of 2023 and the Federal Reserve refraining from upping the 10-year TIPS yield. Also, the S&P must outperform the commodity index.

“We do not think a ‘classic’ U.S. recession has begun, and yet the S&P 500 has already fallen in-line with a post-WW2 recession average,” he wrote.

Bannister’s call comes after the S&P and major averages capped off their best week since June on Friday. Strategists have been tweaking estimates as the end of the year approaches. BMO Capital Markets’ chief investment strategist Brian Belski trimmed his year-end S&P price target to 4,300, saying he had underestimated the influence of inflation. Other banks including Citigroup have cut expectations in recent weeks.

Near-term trends favor cyclical stocks like the beaten-up semiconductors, media and entertainment and tech hardware stocks, Bannister said.

But to be sure, he does see risks ahead beyond 2023, noting that a “secular bear market” is underway over the next decade. This environment supports an active management strategy favoring defensives during a slowdown and cyclical stocks during recoveries, he added.

“Longer term, from the Jan-3, 2021 S&P 500 high (4,800 nominal, 5,100 real), we see the P/E ratio cut in half in the 10 years 2021 to 2031E offset by EPS doubling in the same period (7.2% CAGR), which leaves the S&P 500 index price about flat in 2031 versus 2021 in real or nominal terms,” Bannister wrote.

—CNBC’s Michael Bloom contributed to this report.